CinemaCon is known for bringing out all the stars such as Tom Cruise and Scarlett Johanssen to the stage, but for the first major event of the shows, it is the titans of productions and exhibition that square it off over a proverbial round table (actually a row of chairs). In a candid industry summit that revealed both optimism and lingering concerns, top executives from global exhibition and distribution powerhouses sat down to address the evolving theatrical landscape in a panel titled "Globally Speaking: Different Perspectives, One Common Goal." There were both differences and unity on display.

The conversation, moderated by the newly re-christened Cinema United's Michael O'Leary, brought together Warner Bros.' Jeff Goldstein, Paramount's Mark Viane, Cinépolis' Alejandro Ramírez Magaña, and Vue's Tim Richards for an unusually frank assessment of where theatrical stands in 2025 — and the stark differences between international and domestic recoveries at a show that is both the largest US and international confab for the cinema industry.

Europe's Stronger Recovery: Local Content and Longer Windows

What was clear from the outset was that European and international markets have rebounded more robustly than North America, a disparity the panelists attributed to two key factors: local film production and theatrical exclusivity periods.

"In Europe, we have the benefit of local filmmakers, which you don't see as much in the domestic market," explained Vue CEO Tim Richards. "In a market like France last year, 44% of box office was French films. Across Europe, three or four of the top 10 highest grossing films every year are local films."

Cinépolis CEO Alejandro Ramírez Magaña pointed to another crucial factor: "Europe has a more consistent and longer window before movies get released in PVOD. In most European countries, the average window is above 75 days, while in the US it's around 34 days. That plays to the faster recovery of Europe."

While Paramount's Mark Viane diplomatically noted, "We're not going to talk about windows here," he acknowledged the importance of local production, observing that "when you can have anywhere from 40 to 50% of your business coming from local productions, then on top of that, you have the Hollywood fare, obviously, you're going to be an incredibly healthy market."

Digital Piracy: The Elephant in the Room

Ramírez Magaña called out digital piracy as a growing threat, particularly related to shorter US windows creating global ripple effects.

"The nature of piracy changed with the advent of digital technologies," he said. "In the past, people had to get out of their homes and buy a pirated Blu-ray or DVD disc. Now they can download pirated films from the comfort of their couch with a click."

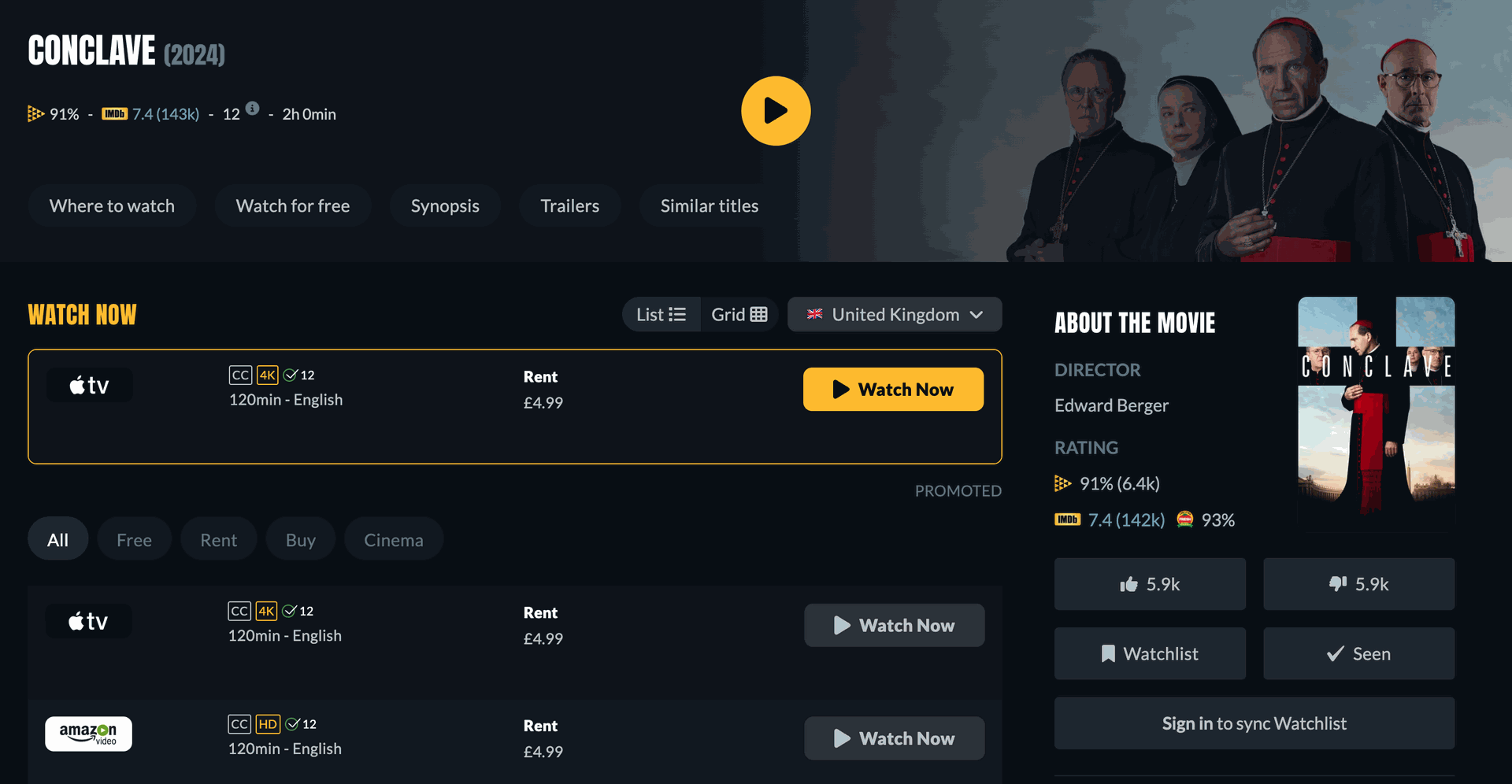

He specifically cited "Conclave" as an example where early PVOD availability in the US damaged theatrical performances in international markets releasing later. "The early release of a PVOD window in the US drives earlier peaks in global piracy," Ramírez Magaña stressed.

In a notable observation, O'Leary pointed out that "Conclave's demographic isn't necessarily the age group you associate with piratical activity," suggesting the problem extends beyond younger audiences typically associated with digital piracy.

The Economics of Filmmaking

Warner Bros.' Jeff Goldstein broadened the discussion to underlying industry economics. "There's a bigger story here and that's the economics of making motion pictures and what's that value proposition," he said. "Technology has brought a huge amount of positives, but there's also been a huge amount of negatives in our business." Generative AI was clearly the elephant in the conference room.

Goldstein referenced pre-pandemic concerns that now appear prescient. "We used to talk about pre-pandemic that we were upside down on half our slate. And we always said that's not sustainable. How is it that a studio could lose money on half the slate, but maybe their partners and customers are making money on every title?"

Richards struck the most optimistic tone, suggesting the industry's shared pandemic trauma had fostered unprecedented cooperation.

"When you've been through a pandemic, there's not much more that can scare you anymore," he said. "I know our relationship in all of our markets with the studios now has never been better. We are doing what we should be doing — sharing information. We're in the front line with our customers, we market and promote films together, and we both win as a consequence."

Viane echoed this sentiment: "The collaboration now between exhibition and distribution, it's never been better. Everyone is really trying to find that angle and that little niche of how do we get just a little bit better."

The Pre-Show 'Problem'

In one of the panel's more surprising moments, Paramount's Viane questioned the industry's approach to pre-show advertising, a topic that had not been on the industry’s radar much recently.

"I'm worried about the pre-show, about what's going on in cinemas," he said. "In today's world, you could sit at home and have Netflix and not watch any commercials. But now we're telling people to go to the cinema and watch commercials. It's almost counterintuitive."

European operators defended their pre-show practices, with Richards noting, "In Europe, our customers have had advertisements for 30, 40 years. They are high quality ads — this isn't Farmer John's second-hand cars. These are movie quality ads that go to the Lions in Cannes for global awards." Once again, the US-European split of industry perspectives was made manifest.

Ramírez Magaña acknowledged the delicate balance: "There's always the temptation to sell more ads, to make longer pre-shows, but that is affecting the customer experience. Our aspiration is not to have pre-shows longer than 15 minutes."

On trailer length and quantity, consensus emerged around four trailers as ideal, with Goldstein advocating for variable lengths: "I'm an advocate for different lengths of trailer, not all trailers need to be two and a half minutes. At this point in time, I think you're better off sometimes telling your message in 90 seconds or in 45 seconds."

The AI Revolution in Exhibition

Richards revealed Vue's decade-long investment in artificial intelligence has transformed their business – in a good way!

"Ten years ago, we embarked on an AI journey," he said. "It's allowed us to identify all of our customers around every single cinema in every community. We're able to play 50% more films typically than others are able to do, and we play an absolutely extraordinary 46% of foreign language films a year on our screens."

This data-driven approach targets what Richards calls the "80% opportunity" in current 22% occupancy rates. "Working together, we can start to fill those screens," he said. These panel sessions alwayus veer towards unity by the end of them and so here too this year.

Wishlist for Growth

Asked what single change would most help industry growth, the executives revealed telling priorities.

Viane wished for "the slates that we used to have on a constant basis, you know, 2019 before," while Ramírez Magaña added his desire for "a consistent global window of a minimum of 45 days."

Goldstein called for more industry dialogue: "If I had to snap my fingers, it would be to have more of these kinds of conversations in small rooms, medium-sized rooms and large rooms on how do we solve for where we want to be."

He concluded with a forward-looking appeal that captured the panel's mood: "I think we should all make an agreement coming out of CinemaCon that anything that happened before 2020, we're not talking about anymore. It only matters what's happening tomorrow."

O'Leary responded simply: "Look to the horizon." Thus the industry stars left the stage, in Richard’s case to pick up an award, before it was the turn of the Hollywood stars to bring even more optimism to this year’s CinemaCon.

CinemaCon 2025: Exhibition and Distribution Chiefs Navigate Cinema's New Global Reality